Latest data shows the European Toys and Games market will benefit from licensed toys and new products for the Christmas sales period and 2024.

Circana , formerly known as IRI and The NPD Group, has announced new insights into the European toy market at this year’s Brand Licensing Europe 2023.

, formerly known as IRI and The NPD Group, has announced new insights into the European toy market at this year’s Brand Licensing Europe 2023.

Across the seven largest markets in Europe (the UK, France, Germany, Italy, Spain, Belgium and The Netherlands) Circana has tracked €7.9b worth of toy sales this year to the end of August 2023: a decline of -3.6% in value terms compared to the same period in 2022.

Faced with an inflationary context not seen since the 1980s, many consumers are being forced to reduce their consumption of FMCG goods and services. Decreased disposable income and an increasing consciousness about the impact of consumerism on the planet is leading many to make radical changes to what they buy.

“Like many discretionary categories, the toy market is fighting to maintain its share of consumers’ wallets,” commented Melissa Symonds, UK Toys director for Circana. “A decline in disposable income, drops in birth rates and unpredictable weather (which always has a direct impact on sales of outdoor toys), have all contributed to the decline in the toy market value sales. But one way manufacturers are reaching consumers’ hearts is to capitalise on the power of fandom. As a result, the licensing market is booming.”

Summer trends

Due to unpredictable weather, sales of outdoor and sport toys have declined by -16.5% YTD and -15.5% for the three summer months (June to August), where they represent no less than 16% of European toy sales.

However, three super categories have seen their sales increase: Building Sets (+0.3%), Games and Puzzles (+7.3%) and Plush (+9.4%). The top 5 gaining classes YTD include Strategic Trading Card Games, Traditional Plush, Card Games, Non-Strategic Trading Cars and Stickers, and Action Figure Collectibles.

Licensed merchandise continues to play a big part in the toy market across Europe and has seen a big boost in the wake of a number of Summer blockbuster movie releases. Across the EU7 (UK, France, Germany, Italy Spain, Belgium and the Netherlands), licensing now makes up 27% of total spend in toy sales, rising from 22% in 2020 – an impressive gain of +26% in three years.

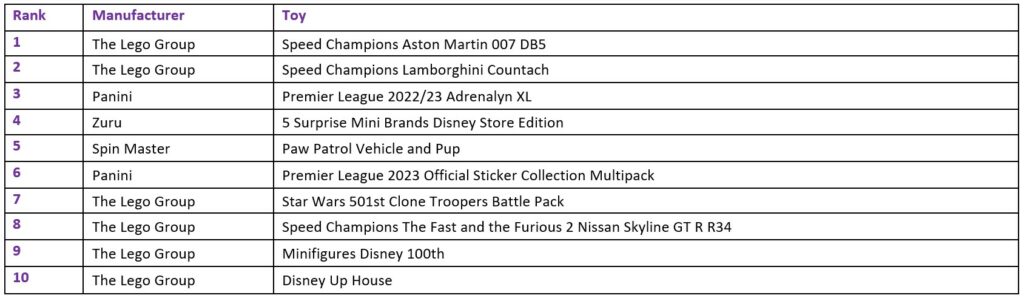

The top 10 character-driven toys by sales value in the UK market (YTD August 2023, £ sales) are:

“The licensing of movies, video games and sporting events are all fuelling growth of toy sales,” added Melissa. “The licensing of toys is keeping the sector in great shape as we move into the all-important Q4 holiday period. With the wealth of content available and more coming down the pipe, it will be fascinating to see just how high the share of licensed sales in the toy market can go in 2024 – though I do expect the 148 days of the Writers Guild of America strike to have a measured impact on the flow of new toys.”